ACA Premiums Surge, Hitting Middle-Class Families Hard in 2026

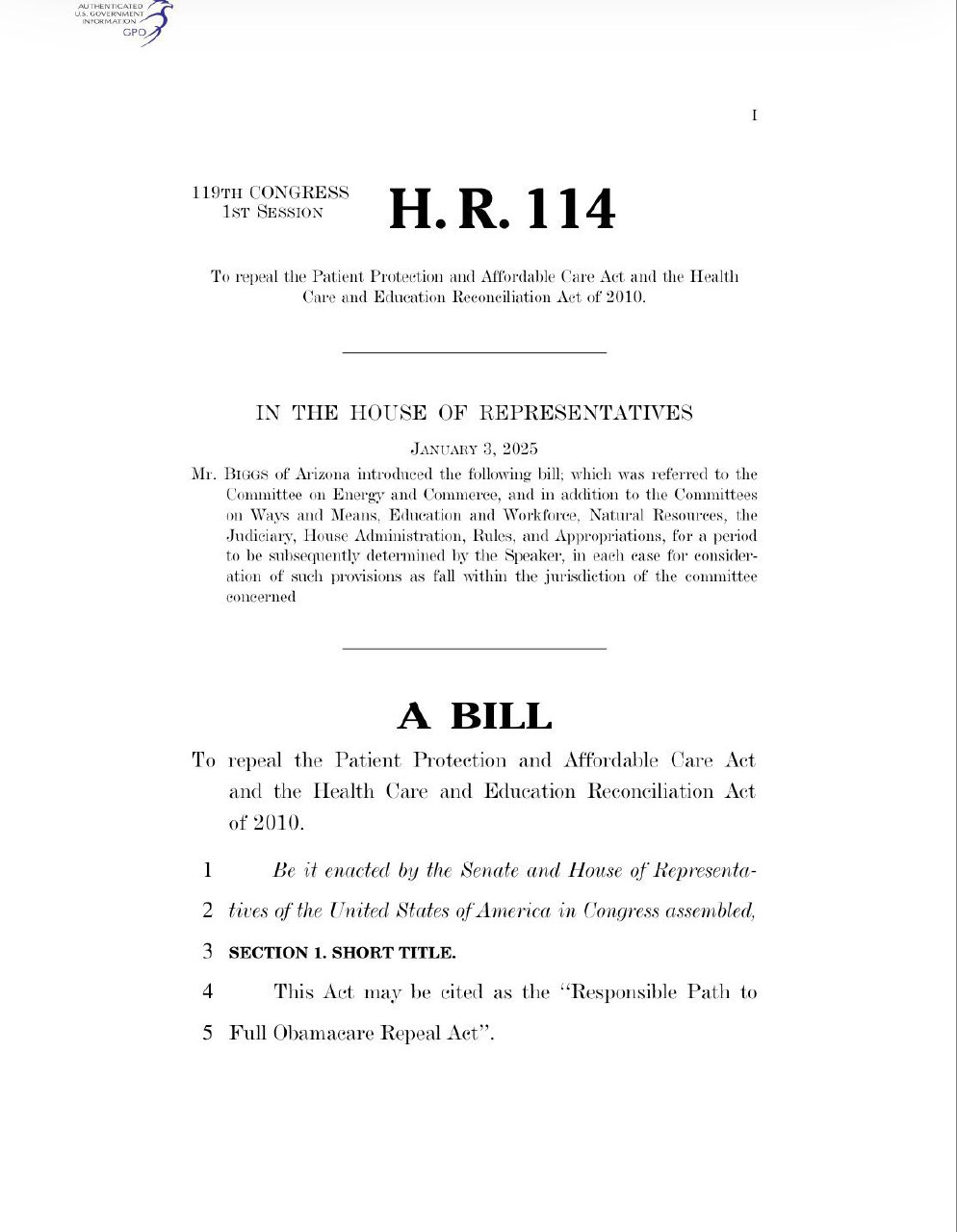

Premiums for health insurance plans under the Affordable Care Act (ACA) are set to experience significant increases in 2026, with some plans projected to rise from $250 in 2025 to over $2,800. This surge is primarily attributed to changes in subsidies linked to the American Rescue Plan, which are expected to disproportionately affect middle-income families.

According to a health insurance broker, the impending changes in subsidy eligibility will leave many single earners making over $60,000 and couples earning more than $84,000 without tax credits. This shift is poised to create financial strain for retirees and everyday Americans who rely on these subsidies to afford healthcare costs.

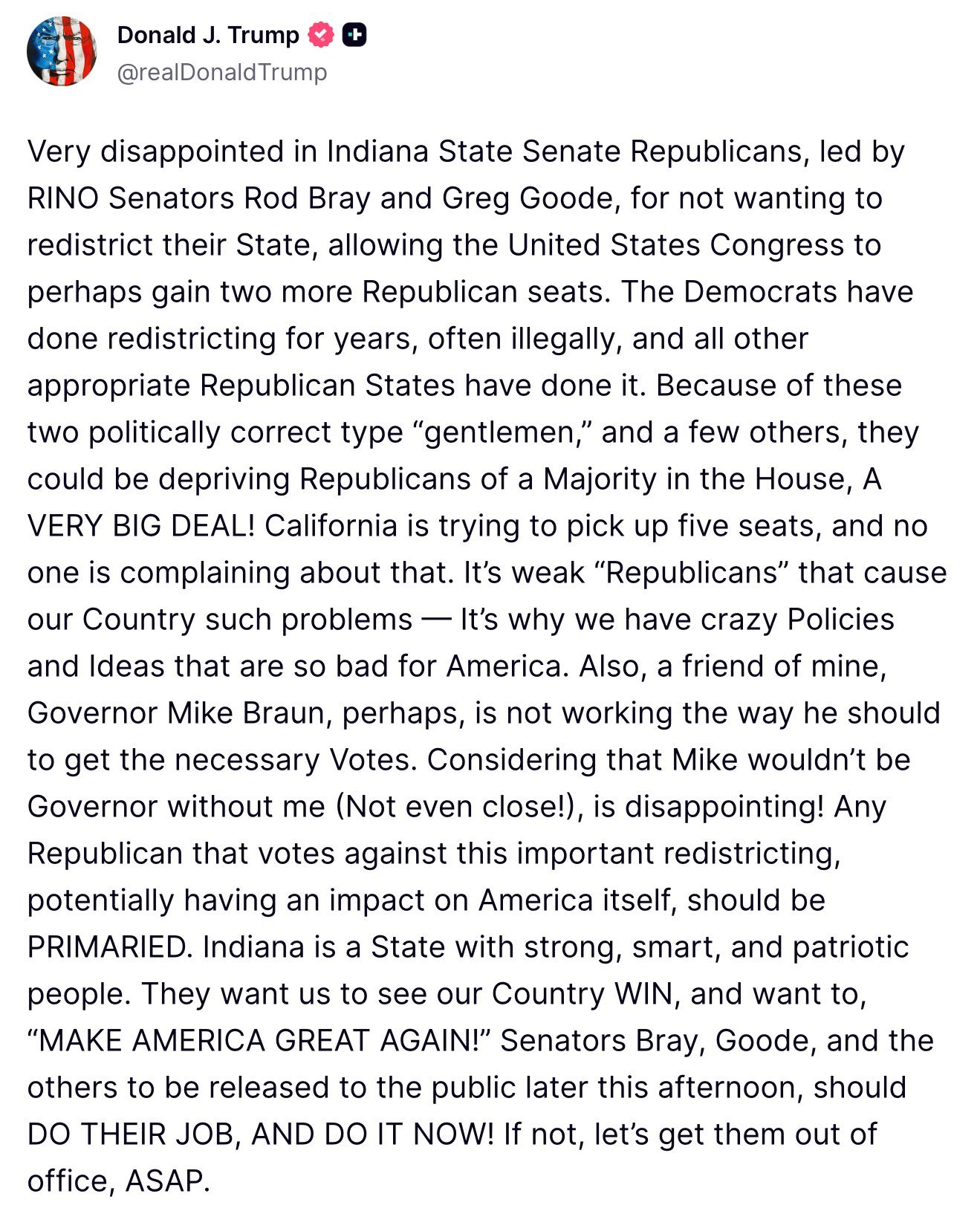

The ACA was initially designed to make healthcare more accessible and affordable for millions of Americans. However, the upcoming adjustments to premium costs and subsidy structures are raising concerns among middle-class families who may find themselves facing unprecedented healthcare expenses. As premiums skyrocket, many individuals and families are left questioning their ability to maintain adequate health coverage.

Experts warn that the elimination of tax credits for many middle-income earners could lead to a significant increase in the number of uninsured individuals. The financial burden of high premiums may force some families to forgo necessary medical care or to seek alternative, potentially less comprehensive insurance options.

The situation highlights the ongoing challenges within the U.S. healthcare system, particularly as policymakers grapple with the balance between providing affordable coverage and managing the financial implications of subsidy programs. As the 2026 enrollment period approaches, the ramifications of these changes will likely prompt discussions among lawmakers and stakeholders about the future of the ACA and the need for reforms to protect vulnerable populations.

As families prepare for the upcoming changes, many are urged to explore their options and stay informed about potential impacts on their healthcare coverage. The landscape of health insurance is evolving, and the implications of these premium increases will be felt across the nation.